In the ever-evolving landscape of financial markets, forex auto trading Islamic FX Trading stands out as a crucial player. The Forex market, known for its volatility and vast potential for profit, has increasingly attracted both seasoned investors and newcomers alike. As technology advances, traders are turning to auto trading systems to capitalize on market opportunities with minimal manual intervention.

What is Forex Auto Trading?

Forex auto trading, often referred to as automated trading, is the process of using software to execute trades on behalf of the trader. These automated systems, also known as Expert Advisors (EAs) or trading robots, analyze market data and execute trades based on predefined algorithms, eliminating the need for constant monitoring by the trader.

How Does Forex Auto Trading Work?

The core of Forex auto trading relies on algorithms and historical data analysis. Traders set their trading parameters, including conditions for entry and exit, risk management strategies, and other relevant indicators. The software then continuously scans the market for opportunities that meet these criteria, executing trades automatically when conditions are right.

Key Components of Auto Trading Systems

- Algorithms: At the heart of any auto trading system is the algorithm, a set of rules that dictates how trades are executed. These can range from simple moving averages to complex machine learning models.

- Backtesting: Before deploying any auto trading strategy, it is crucial to backtest it using historical data to assess its effectiveness and potential profitability.

- Execution: Once the trading criteria are met, the system executes trades on the user’s behalf, often in a matter of milliseconds.

Advantages of Forex Auto Trading

One of the primary advantages of using an auto trading system is the efficiency it offers. Here are some notable benefits:

- 24/5 Trading: The Forex market operates 24 hours a day, five days a week. Automated trading systems can operate continuously, ensuring that no potentially profitable trades are missed even when the trader cannot monitor the market.

- Emotionless Trading: Emotional decision-making is a common pitfall for many traders. Auto trading eliminates this issue by following a predefined set of rules without being influenced by fear or greed.

- Time-Saving: With automated systems handling trading, traders can save valuable time and allocate it towards other activities, such as learning and market research.

- Consistency: Automated systems can operate on strict rules, leading to a more consistent trading approach. This can help in maintaining discipline, which is crucial for trading success.

Challenges of Forex Auto Trading

While auto trading offers numerous advantages, it is not without its challenges:

- Dependence on Technology: A significant reliance on technology means that any software glitches, connectivity issues, or power failures can lead to missed opportunities or losses.

- Market Conditions: Automated trading systems can struggle in rapidly changing market conditions or during high volatility events where their algorithms may not respond appropriately.

- Over-Optimization: There is a risk of over-optimizing algorithms based on past performance, leading to systems that perform well historically but fail in live trading.

Getting Started with Forex Auto Trading

For those interested in venturing into Forex auto trading, here are some practical steps to consider:

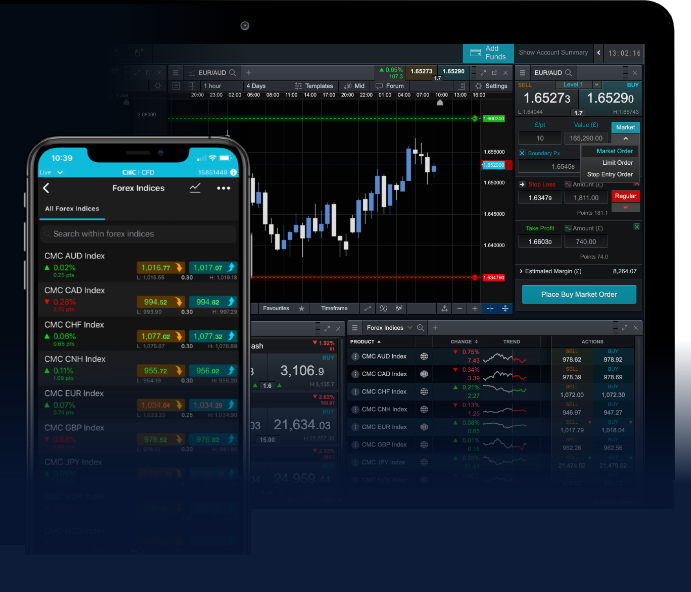

- Choose a Reliable Trading Platform: Start by selecting a reputable trading platform that supports automated trading and provides access to necessary tools and resources.

- Develop a Strategy: Before deploying an auto trading system, create a solid trading strategy that outlines entry and exit conditions, money management rules, and risk parameters.

- Backtest Your Strategy: Use historical data to backtest your trading strategy to determine its effectiveness and make necessary adjustments before live trading.

- Start Small: Begin with a demo account or trade with small amounts to evaluate the system’s performance without risking significant capital.

Conclusion

Forex auto trading represents a significant shift in how traders operate within the financial markets. By leveraging technology and algorithmic analysis, traders can potentially enhance their trading performance while minimizing emotional interference. However, it requires a well-thought-out strategy, thorough backtesting, and careful risk management to navigate the challenges it presents. As you embark on your auto trading journey, remember the importance of continuous learning and adaptation in this dynamic marketplace.

Comentarios recientes